Tips On How To Understand The Average Home Equity Loan Rate

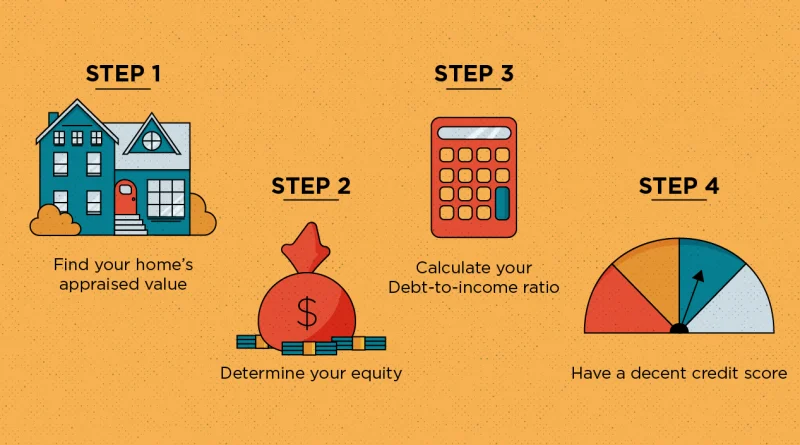

To understand the average home equity loan rate, you should first know what you are looking for. The rate will vary based on several factors, including the value of your home, the amount you are looking to borrow, and how many years you will need to repay it. You may also want to know your credit score so that you can qualify for a lower rate. If you have a high credit score, you can apply for a loan with lower interest rates.

Interest rates are fixed

The average home equity loan rate is lower than it was 10 years ago. Although rates are currently on the rise, it is still a better deal than credit card interest rates. This article will discuss the differences between a home equity loan and a home equity line of credit. By knowing the difference, you’ll be able to make an informed decision about which option is best for you. Here are some common questions that you should ask yourself to make the best decision for you.

First of all, what is equity? Your equity is the amount of money that your home is worth minus the outstanding mortgage balance. When you take out a home equity loan, you can borrow up to 85% of the value of your home. Although lenders vary in the amount of equity you can borrow, you should know that most lenders will allow you to borrow up to 85% of your home’s value. You’ll be able to pay off the loan in full when you sell your home.

You can borrow against your home’s value

You can borrow against the value of your home to cover unexpected expenses. While home equity is a great resource to use when you need to, there are some disadvantages. Saving three to six months’ worth of living expenses is a good rule of thumb. If you don’t have enough cash on hand, you may have to take out a personal loan or charge the purchase on your credit card and pay it back over time. If you have enough equity in your home, however, borrowing against it may be a great option for you.

Home equity loans have various terms and conditions. The amount of money you can borrow depends on your age, equity in your home, and current interest rates. You can receive the loan proceeds in a lump sum, regular monthly payments, or in the form of a line of credit. If you’re looking for a lower interest rate, you can go with a cash-out refinancing option. However, keep in mind that if you sell your home, you have to pay back the loan. If you sell your home, you can get a profit from it and pay back the loan.

You need a cosigner

Most banks offer a home equity loan with an 80% loan-to-value ratio. So, if you have $75,000 in equity, you could qualify for a loan of $60,000, which would be paid off over five to fifteen years. Once you receive your loan, you’ll need to make regular payments on it until you’ve paid off the full balance. You may also need a cosigner to avoid getting turned down.

To get the best interest rate, you’ll need to improve your credit score. By making on-time payments on all your debts and avoiding new applications for credit cards, you’ll have a better chance of receiving a lower interest rate on your home equity loan. This is because lenders use your credit score to predict how likely you are to pay the loan. Another factor lenders consider is your debt-to-income ratio (DTI), and the lower your DTI percentage, the better.

You can get a lower rate if your credit score is at least 680

In general, if your credit score is at least 6800, you can expect to get a better interest rate on your loans. This credit score may not be considered excellent, but it is still considered good. This credit score range is determined by Credit Karma. This number is used by lenders to determine what they consider to be good credit. A credit score of 680 can get you a better rate on a loan, but it does not guarantee that you’ll get the best rate.

However, if your credit score is at least 6800, you will still have a difficult time qualifying for a conventional loan. Even though the minimum score for conventional loans is 580, some lenders cater to borrowers with a credit score below this. If you have a credit score in this range, you may need to choose between a conventional loan and an FHA loan.

You can shop around for the best rate

Bankrate gathers the rates of the country’s top 10 lending institutions, and then compiles these data to find the best home equity loan rate. Lenders typically don’t lend more than 80% of the value of your home, so your FICO score must be at least 700 to qualify. Besides low interest rates, the best home equity loan lenders also offer competitive repayment terms. However, the qualifications for home equity loans depend on several factors, including credit score, loan amount, and length of repayment.

While you can shop around for the best home equity loan rates at a variety of lenders, banks are the best place to begin your search. A bank that has a good relationship with you may be the best place to start. Regardless, it is best to compare rates, fees, and loan terms of several lenders before selecting one. You can also take advantage of prequalification forms provided by various lending institutions, which don’t impact your credit score.